Original Medicare

You will be automatically enrolled in Original Medicare Part A & Part B when you are eligible and start receiving your Social Security benefits. It may not be the best Medicare healthcare plan available to you. Original Medicare can leave you at greater financial risk

and with higher costs for benefits not covered by Original Medicare.

Pros

-

See any doctor, anywhere, who accepts Medicare.

-

Not restricted to healthcare network. (IASIS, Mountain Star, Intermountain Healthcare or University Of Utah)

Cons

-

You are are responsible for 20% of your medical costs.

-

No limit on your 20% total annual out-of-pocket costs.

-

You are own your own to deal with Medicare. No licensed, local agent to assist you when dealing with Medicare claims & coverage issues.

-

Prescription drugs, vision, hearing, and dental not included.

Frequently Asked Medicare Questions:

What Is Medicare?

Medicare is...

-

A federal health insurance program for eligible U.S. citizens and legal residents

-

Funded in part by taxes you pay while working

-

Individual health insurance

Medicare is not...

• A family health plan • Social Security

• Medicaid

• Free

Who Can Get Medicare?

U.S. citizens and legal residents

Legal residents must live in the U.S. for at least 5 years in a row,

including the 5 years just before applying for Medicare.

You must also meet one of the following requirements:

• Age 65 or older

• Younger than 65 with a qualifying

disability

• Any age with a diagnosis of end-stage

renal disease or ALS

What Does Medicare Cover?

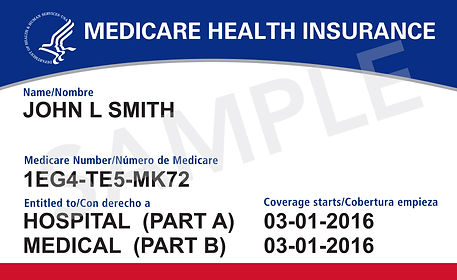

Original Medicare = Parts A & B

• Part A is hospital insurance covering

inpatient hospital and skilled nursing

care

• Part B is medical insurance covering doctor visits and

outpatient care

* Original Medicare does NOT include Part D (Prescription Drug Coverage)

You can enroll in that separately.

What are my Options?

You can add coverage to Original Medicare or choose a Medicare Advantage Plan

You may add a standalone Part D plan, a Medicare supplement plan or

both to Original Medicare (Parts A and B.)

Medicare Advantage

You may choose to get your benefits through a Medicare Advantage Plan ( Part C.) Many plans come with built-in prescription drug coverage. You can add a standalone Part D plan only with certain Medicare Advantage plans.

What Does Medicare Cost?

2021 Original Medicare Part A (Hospital) Costs

• $ 0 monthly premium (for most people)

• $1,408 deductible* per benefit period(up to 60 days)

• $352 per day* for days 61–90 in one benefit period

$704 per lifetime reserve day (maximum of 60 days)

• NO out-of- pocket limit

* If admitted as inpatient to hospital or skilled nursing facility

2021 Original Medicare Part B (Medical) Costs

• A monthly Part B premium ($148.50 in 2021 for most people)

• An annual deductible. A set amount you pay out of pocket for covered services each year before Medicare or your plan begins to pay.

• A copay. A fixed amount you pay at the time you receive a covered service. Medicare or your plan pays the remaining balance.

• Coinsurance. A percentage of the cost for a covered service that you pay when you receive it. For example, you might pay 20% and Medicare or your plan would pay 80%.

_edited_p.png)